Following

Perplexity Finance

10 条推文

Perplexity Finance

@PPLXfinance

29

正在关注

40515

关注者

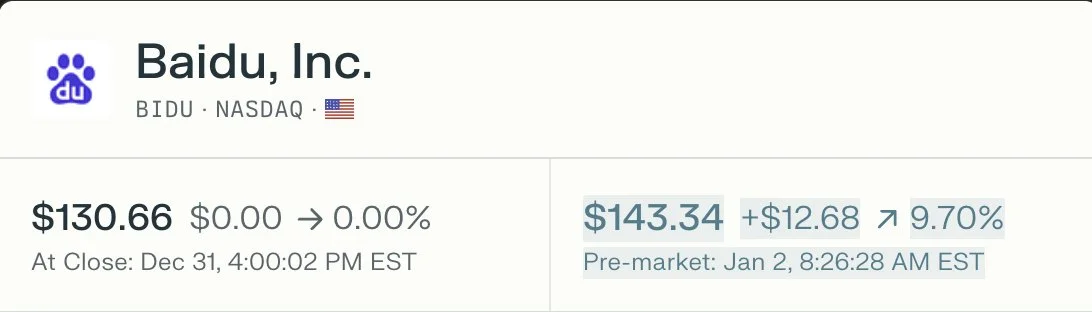

BREAKING: Baidu just announced a spin-off of its AI chip unit Kunlunxin for a separate Hong Kong listing

$BIDU ripping +9% pre-market

$BIDU ripping +9% pre-market

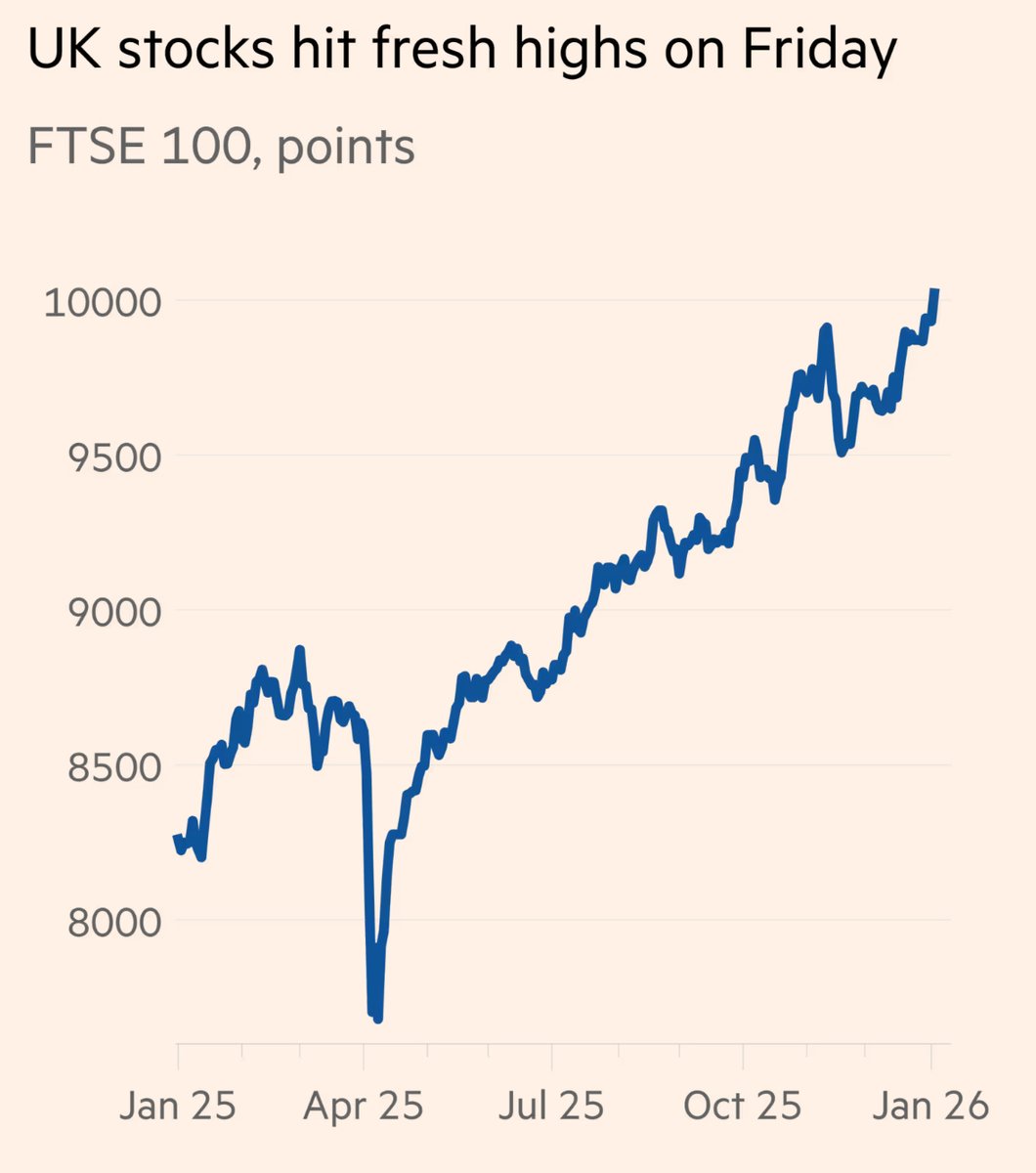

BREAKING: UK's FTSE 100 index has surpassed 10,000 points for the first time in its history

A historic moment and a brilliant start to 2026 for the UK stock market!

A historic moment and a brilliant start to 2026 for the UK stock market!

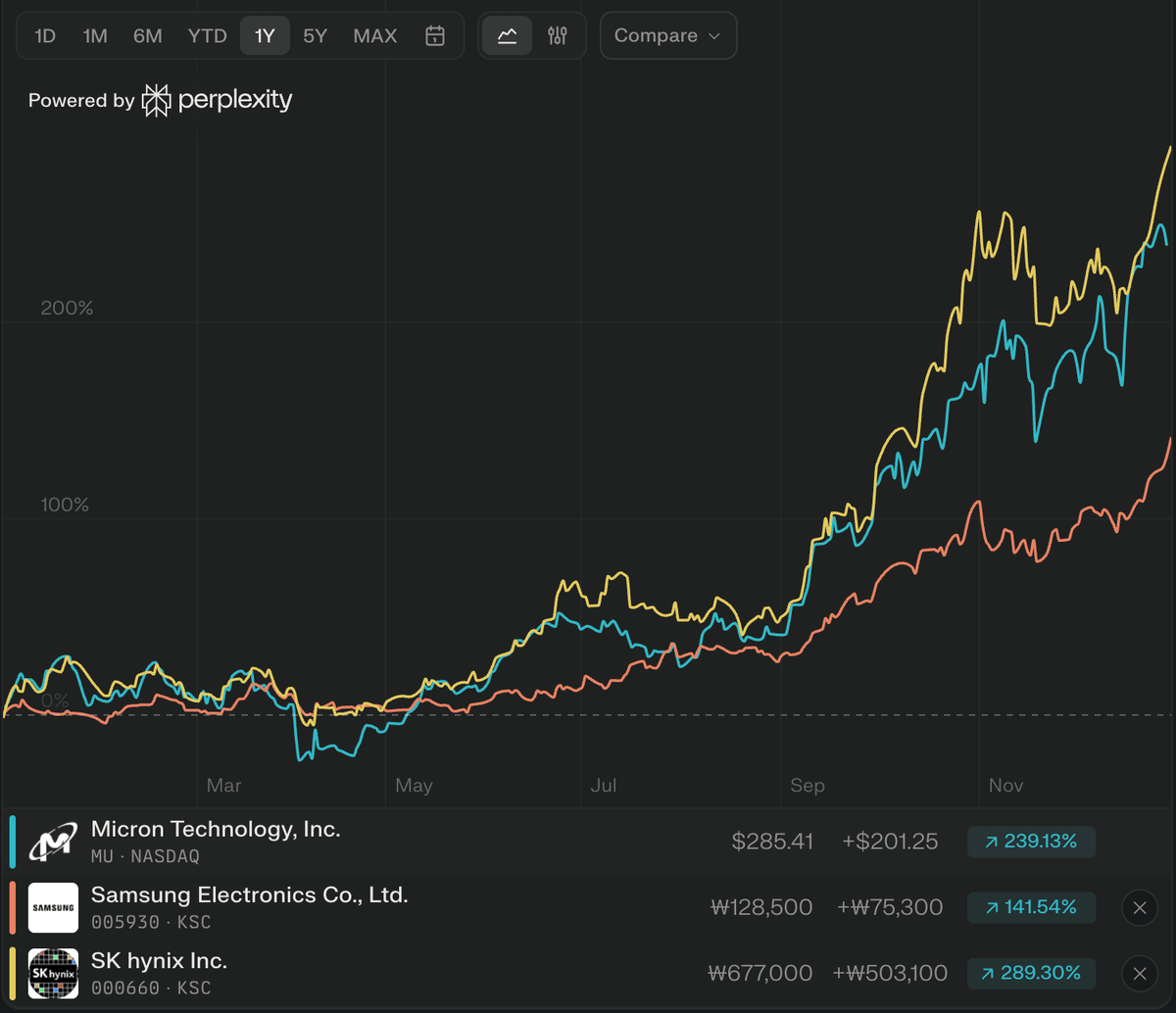

🚨 Citi is extremely bullish on memory chips amid AI-fueled demand and ongoing supply shortages into 2026+

They raised Samsung Electronics' target to 200,000 KRW, expecting massive DRAM price growth and 2026 operating profit up 35%

For Micron $MU, Citi's latest target is $330, with HBM sold out for 20

They raised Samsung Electronics' target to 200,000 KRW, expecting massive DRAM price growth and 2026 operating profit up 35%

For Micron $MU, Citi's latest target is $330, with HBM sold out for 20

🚨 鉴于人工智能驱动的需求和持续到 2026 年及以后的供应短缺,花旗集团对存储芯片极为看好。

他们将三星电子的目标价上调至 200,000 韩元,预计 DRAM 价格将大幅上涨,2026 年营业利润将增长 35%。

对于美光 $MU,花旗的最新目标价为 330 美元,预计 HBM 销售至 2026 年售罄,并大幅上调了盈利预测。

对于 SK 海力士,花旗将其目标价上调至 830,000 韩元,强调了其 HBM 领导地位,产能已预订至 2027 年,并将其 2026 年营业利润预测上调了 12%。

他们将三星电子的目标价上调至 200,000 韩元,预计 DRAM 价格将大幅上涨,2026 年营业利润将增长 35%。

对于美光 $MU,花旗的最新目标价为 330 美元,预计 HBM 销售至 2026 年售罄,并大幅上调了盈利预测。

对于 SK 海力士,花旗将其目标价上调至 830,000 韩元,强调了其 HBM 领导地位,产能已预订至 2027 年,并将其 2026 年营业利润预测上调了 12%。

3 largest private companies worth combined over $1.5 TRILLION preparing to IPO in 2026

- SpaceX: $800B valuation, told investors they’re going public within 12 months

- OpenAI: Currently $500B, in talks for $750B+ raise, then IPO

- Anthropic: Expecting $300B+ valuation

- SpaceX: $800B valuation, told investors they’re going public within 12 months

- OpenAI: Currently $500B, in talks for $750B+ raise, then IPO

- Anthropic: Expecting $300B+ valuation

三家估值总和超 1.5 万亿美元的最大私营公司计划于 2026 年首次公开募股(IPO):

- SpaceX:估值 8000 亿美元,已告知投资者将在 12 个月内上市

- OpenAI:目前估值 5000 亿美元,正在洽谈 7500 亿美元以上的融资,之后 IPO

- Anthropic:预计估值将超过 3000 亿美元 https://t.co/qwc4fXjwco

- SpaceX:估值 8000 亿美元,已告知投资者将在 12 个月内上市

- OpenAI:目前估值 5000 亿美元,正在洽谈 7500 亿美元以上的融资,之后 IPO

- Anthropic:预计估值将超过 3000 亿美元 https://t.co/qwc4fXjwco

BREAKING: U.S. government approves annual licenses for Samsung + SK Hynix to ship chipmaking equipment to China in 2026

$MU +1% pre-market

$MU +1% pre-market

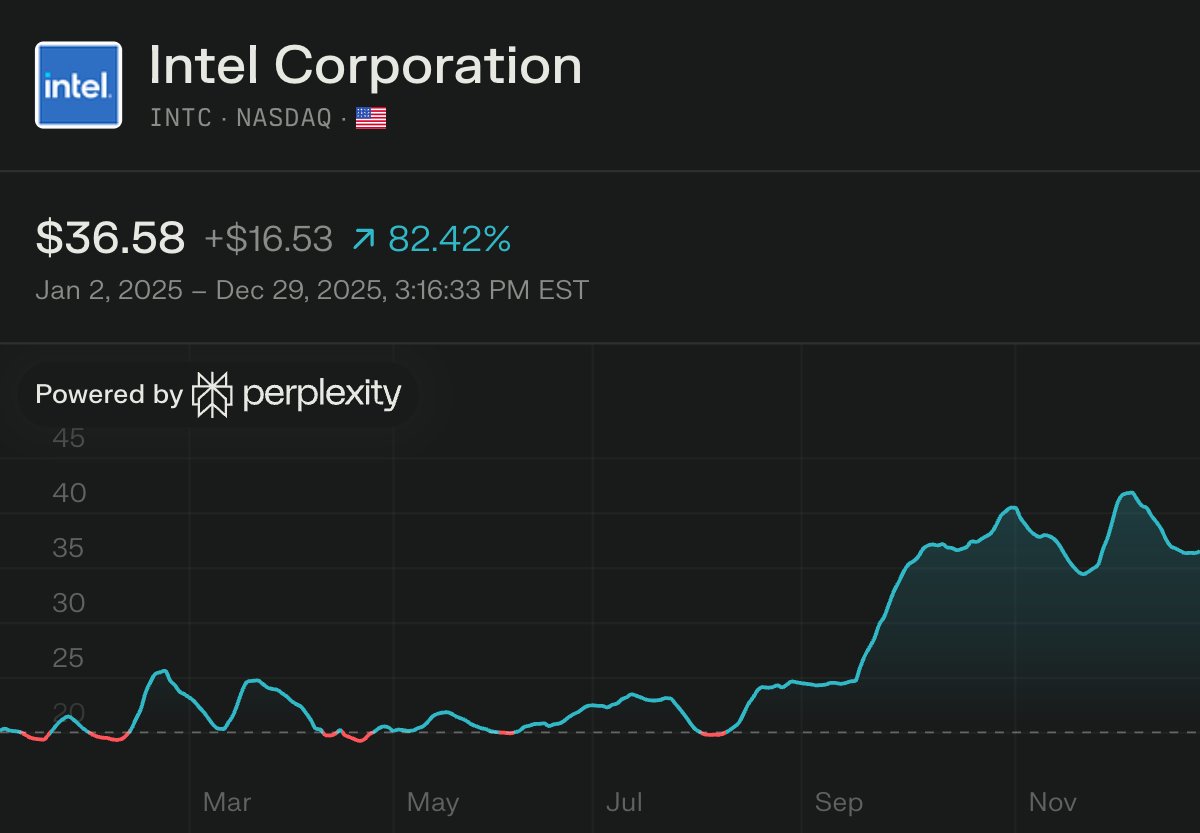

$INTC stock is up 82%+ this year!

The U.S. government owns 10% of Intel

Nvidia owns 4%

SoftBank owns 2%

Intel is a national security asset now. 2026 foundry deals are incoming.

The U.S. government owns 10% of Intel

Nvidia owns 4%

SoftBank owns 2%

Intel is a national security asset now. 2026 foundry deals are incoming.

英特尔(INTC)股价今年已上涨82%以上!

美国政府持有英特尔10%的股份

英伟达持有4%

软银持有2%

英特尔现在是国家安全资产。2026年的晶圆代工交易即将到来。https://t.co/8BuRBWftnv

美国政府持有英特尔10%的股份

英伟达持有4%

软银持有2%

英特尔现在是国家安全资产。2026年的晶圆代工交易即将到来。https://t.co/8BuRBWftnv

Perplexity Finance

@PPLXfinance

Perplexity Finance

@PPLXfinance

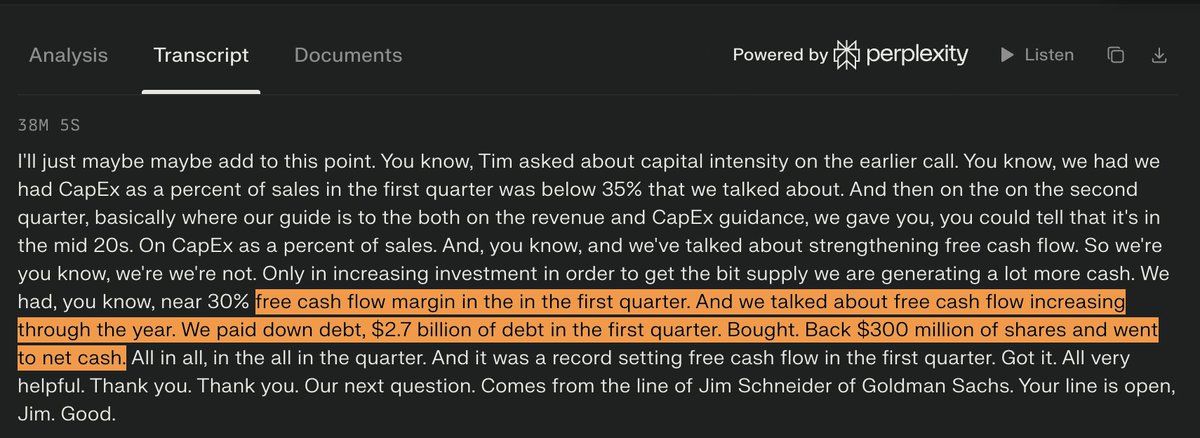

6/ The Cash Machine Is Printing

Almost buried in the call — Murphy casually mentioned:

"We had near 30% free cash flow margin in the first quarter. And we talked about free cash flow increasing through the year. We paid down $2.7 billion of debt in the first quarter. Bought

Almost buried in the call — Murphy casually mentioned:

"We had near 30% free cash flow margin in the first quarter. And we talked about free cash flow increasing through the year. We paid down $2.7 billion of debt in the first quarter. Bought

6/ 现金机器正在印钞

在财报电话会议中,墨菲不经意地提到:

“第一季度我们的自由现金流利润率接近 30%。我们曾说过自由现金流将在全年持续增长。第一季度我们偿还了 27 亿美元的债务,回购了 3 亿美元的股票,并实现了净现金。所有这些都在一个季度内完成。这是创纪录的自由现金流。”

他们产生的现金多到足以偿还近 30 亿美元的债务,回购股票,并且实现了创纪录的流动性。所有这些都是在将建筑支出翻倍的同时完成的。

在财报电话会议中,墨菲不经意地提到:

“第一季度我们的自由现金流利润率接近 30%。我们曾说过自由现金流将在全年持续增长。第一季度我们偿还了 27 亿美元的债务,回购了 3 亿美元的股票,并实现了净现金。所有这些都在一个季度内完成。这是创纪录的自由现金流。”

他们产生的现金多到足以偿还近 30 亿美元的债务,回购股票,并且实现了创纪录的流动性。所有这些都是在将建筑支出翻倍的同时完成的。

7/ Customers Are Getting Told to Find Other Sources

Sadana on how they're handling the shortage:

"A lot of work that we are doing is to try and assess the threshold level of supply that each of our customers need, encourage them to also figure out other sources of supply in

Sadana on how they're handling the shortage:

"A lot of work that we are doing is to try and assess the threshold level of supply that each of our customers need, encourage them to also figure out other sources of supply in

7/ 客户被告知寻找其他供应源

Sadana 谈论他们如何应对短缺:

“我们所做的很多工作是为了评估每位客户所需的供应阈值水平,并鼓励他们在我们可能无法满足其全部需求的环境中,也设法寻找其他供应来源。”

再读一遍。

美光告诉客户:“我们无法供应给你们。去找别人吧。”问题是根本没有别人。SK 海力士和三星也同样受限。

Sadana 谈论他们如何应对短缺:

“我们所做的很多工作是为了评估每位客户所需的供应阈值水平,并鼓励他们在我们可能无法满足其全部需求的环境中,也设法寻找其他供应来源。”

再读一遍。

美光告诉客户:“我们无法供应给你们。去找别人吧。”问题是根本没有别人。SK 海力士和三星也同样受限。

Perplexity Finance

@PPLXfinance

Perplexity Finance

@PPLXfinance

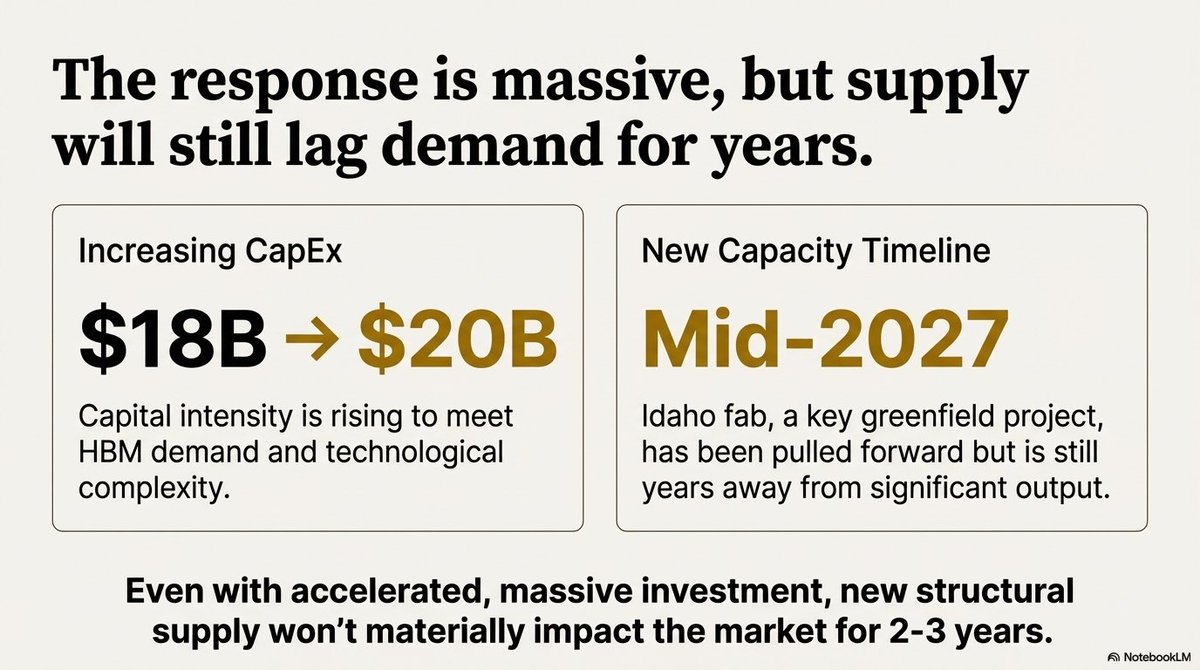

5/ "The Most Complex Factories on the Planet"

Murphy on why they can't just flip a switch and make more:

"Greenfield capacity needs to be put in place. You've got increasing HBM and the capital intensity associated with that. These are... some of the largest and most complex

Murphy on why they can't just flip a switch and make more:

"Greenfield capacity needs to be put in place. You've got increasing HBM and the capital intensity associated with that. These are... some of the largest and most complex

5/ “地球上最复杂的工厂”

墨菲解释了为什么他们不能直接一按开关就生产更多:

“需要建立新的绿色田地产能。你的人工智能高带宽内存(HBM)需求在增加,随之而来的是资本密集度。这些是……地球上规模最大、最复杂的工厂之一。我们需要合作才能做到这一点。我们将谨慎行事。”

资本支出从180亿美元增至200亿美元。爱达荷州晶圆厂提前至2027年中期。但即使有这一切,供应也要数年才能赶上需求。这不是周期性的紧缩——这是一场结构性的重组。

墨菲解释了为什么他们不能直接一按开关就生产更多:

“需要建立新的绿色田地产能。你的人工智能高带宽内存(HBM)需求在增加,随之而来的是资本密集度。这些是……地球上规模最大、最复杂的工厂之一。我们需要合作才能做到这一点。我们将谨慎行事。”

资本支出从180亿美元增至200亿美元。爱达荷州晶圆厂提前至2027年中期。但即使有这一切,供应也要数年才能赶上需求。这不是周期性的紧缩——这是一场结构性的重组。

6/ The Cash Machine Is Printing

Almost buried in the call — Murphy casually mentioned:

"We had near 30% free cash flow margin in the first quarter. And we talked about free cash flow increasing through the year. We paid down $2.7 billion of debt in the first quarter. Bought

Almost buried in the call — Murphy casually mentioned:

"We had near 30% free cash flow margin in the first quarter. And we talked about free cash flow increasing through the year. We paid down $2.7 billion of debt in the first quarter. Bought

6/ 现金机器正在印钞

在财报电话会议中,墨菲不经意地提到:

“第一季度我们的自由现金流利润率接近 30%。我们曾说过自由现金流将在全年持续增长。第一季度我们偿还了 27 亿美元的债务,回购了 3 亿美元的股票,并实现了净现金。所有这些都在一个季度内完成。这是创纪录的自由现金流。”

他们产生的现金多到足以偿还近 30 亿美元的债务,回购股票,并且实现了创纪录的流动性。所有这些都是在将建筑支出翻倍的同时完成的。

在财报电话会议中,墨菲不经意地提到:

“第一季度我们的自由现金流利润率接近 30%。我们曾说过自由现金流将在全年持续增长。第一季度我们偿还了 27 亿美元的债务,回购了 3 亿美元的股票,并实现了净现金。所有这些都在一个季度内完成。这是创纪录的自由现金流。”

他们产生的现金多到足以偿还近 30 亿美元的债务,回购股票,并且实现了创纪录的流动性。所有这些都是在将建筑支出翻倍的同时完成的。

Perplexity Finance

@PPLXfinance

Perplexity Finance

@PPLXfinance

4/ The HDD Shortage Is Making It Worse

Sadana on why SSD demand is exploding:

"Beyond the underlying growth trend of AI servers using more SSDs, we've also had our customers not have adequate amount of HDD as well. And because of that, there has been a lot of demand coming

Sadana on why SSD demand is exploding:

"Beyond the underlying growth trend of AI servers using more SSDs, we've also had our customers not have adequate amount of HDD as well. And because of that, there has been a lot of demand coming

4/ 硬盘短缺使情况雪上加霜

Sadana 解释 SSD 需求激增的原因:

“除了人工智能服务器使用更多 SSD 的潜在增长趋势外,我们的客户也没有足够的硬盘(HDD)。正因为如此,大量需求涌向了 SSD。”

内存短缺非常严重,正波及到其他存储类别。客户也无法获得 HDD,因此他们大量涌入 SSD,使 NAND 短缺问题更加严重。

Sadana 解释 SSD 需求激增的原因:

“除了人工智能服务器使用更多 SSD 的潜在增长趋势外,我们的客户也没有足够的硬盘(HDD)。正因为如此,大量需求涌向了 SSD。”

内存短缺非常严重,正波及到其他存储类别。客户也无法获得 HDD,因此他们大量涌入 SSD,使 NAND 短缺问题更加严重。

5/ "The Most Complex Factories on the Planet"

Murphy on why they can't just flip a switch and make more:

"Greenfield capacity needs to be put in place. You've got increasing HBM and the capital intensity associated with that. These are... some of the largest and most complex

Murphy on why they can't just flip a switch and make more:

"Greenfield capacity needs to be put in place. You've got increasing HBM and the capital intensity associated with that. These are... some of the largest and most complex

5/ “地球上最复杂的工厂”

墨菲解释了为什么他们不能直接一按开关就生产更多:

“需要建立新的绿色田地产能。你的人工智能高带宽内存(HBM)需求在增加,随之而来的是资本密集度。这些是……地球上规模最大、最复杂的工厂之一。我们需要合作才能做到这一点。我们将谨慎行事。”

资本支出从180亿美元增至200亿美元。爱达荷州晶圆厂提前至2027年中期。但即使有这一切,供应也要数年才能赶上需求。这不是周期性的紧缩——这是一场结构性的重组。

墨菲解释了为什么他们不能直接一按开关就生产更多:

“需要建立新的绿色田地产能。你的人工智能高带宽内存(HBM)需求在增加,随之而来的是资本密集度。这些是……地球上规模最大、最复杂的工厂之一。我们需要合作才能做到这一点。我们将谨慎行事。”

资本支出从180亿美元增至200亿美元。爱达荷州晶圆厂提前至2027年中期。但即使有这一切,供应也要数年才能赶上需求。这不是周期性的紧缩——这是一场结构性的重组。

Perplexity Finance

@PPLXfinance

Perplexity Finance

@PPLXfinance

3/ "More Than Sold Out"

Analyst asked if they're sold out on HBM. Sadana's response:

"We are more than sold out. We have sufficient amount of unmet demand in our models. The demand on us is so much higher than the supply that even small increases in supply are not going to be

Analyst asked if they're sold out on HBM. Sadana's response:

"We are more than sold out. We have sufficient amount of unmet demand in our models. The demand on us is so much higher than the supply that even small increases in supply are not going to be

3/ “供不应求”

分析师问HBM是否已售罄。Sadana的回答是:

“我们是供不应求。我们的模型中存在大量的未满足需求。我们面临的需求远高于供应,以至于即使供应量小幅增加,也无法对这种需求产生影响。”

“供不应求。”

他们的需求量太大了,甚至无法模拟如何满足。

2026年的HBM?产能和定价协议已经锁定。如果你是缺少配额的超大规模云服务商,你只能在场边观望。

分析师问HBM是否已售罄。Sadana的回答是:

“我们是供不应求。我们的模型中存在大量的未满足需求。我们面临的需求远高于供应,以至于即使供应量小幅增加,也无法对这种需求产生影响。”

“供不应求。”

他们的需求量太大了,甚至无法模拟如何满足。

2026年的HBM?产能和定价协议已经锁定。如果你是缺少配额的超大规模云服务商,你只能在场边观望。

4/ The HDD Shortage Is Making It Worse

Sadana on why SSD demand is exploding:

"Beyond the underlying growth trend of AI servers using more SSDs, we've also had our customers not have adequate amount of HDD as well. And because of that, there has been a lot of demand coming

Sadana on why SSD demand is exploding:

"Beyond the underlying growth trend of AI servers using more SSDs, we've also had our customers not have adequate amount of HDD as well. And because of that, there has been a lot of demand coming

4/ 硬盘短缺使情况雪上加霜

Sadana 解释 SSD 需求激增的原因:

“除了人工智能服务器使用更多 SSD 的潜在增长趋势外,我们的客户也没有足够的硬盘(HDD)。正因为如此,大量需求涌向了 SSD。”

内存短缺非常严重,正波及到其他存储类别。客户也无法获得 HDD,因此他们大量涌入 SSD,使 NAND 短缺问题更加严重。

Sadana 解释 SSD 需求激增的原因:

“除了人工智能服务器使用更多 SSD 的潜在增长趋势外,我们的客户也没有足够的硬盘(HDD)。正因为如此,大量需求涌向了 SSD。”

内存短缺非常严重,正波及到其他存储类别。客户也无法获得 HDD,因此他们大量涌入 SSD,使 NAND 短缺问题更加严重。